Note: This story has been updated to include more details of Verifly’s new product offerings.

As thousands of new commercial drone operators enter the market, drone insurance becomes a big issue for many. But what’s the right type of insurance for your business? Here’s our analysis of the costs and benefits of on-demand drone insurance, like Verifly, vs. an annual policy from your broker.

What are the Benefits of On-demand Insurance?

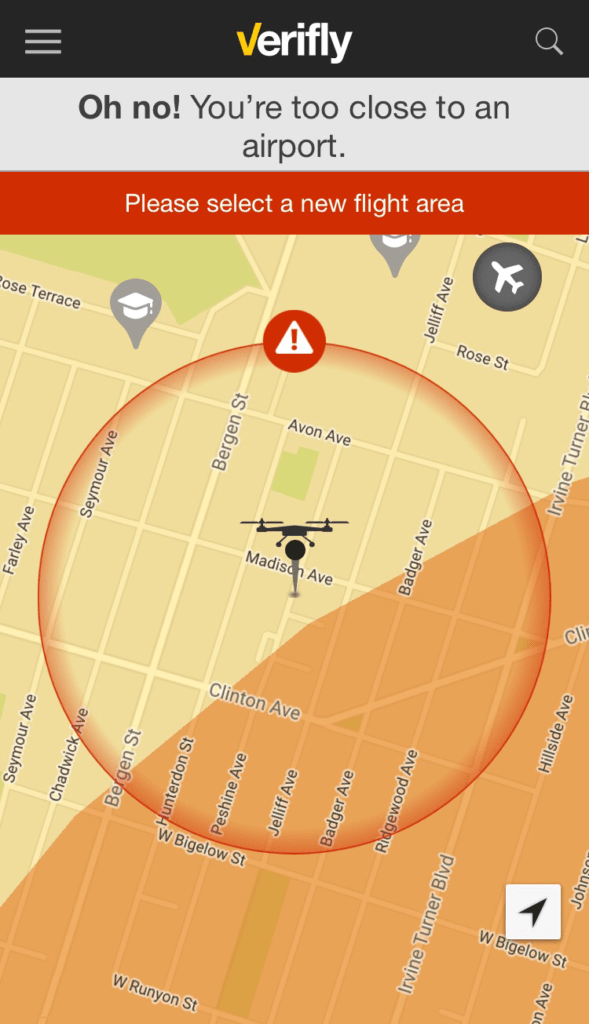

There are three major advantages to on-demand insurance like Verifly: it’s easy, it’s fast, and it’s cheap. And it can help to keep you out of trouble – for example, Verifly won’t insure you if you’re trying to fly in a restricted area. With an app-based product, you can immediately obtain proof of insurance, allowing you to meet on-the-fly (pun intended) demands. “Verifly is for anyone who wants to turbo-charge their business efficiently,” says Verifly’s CEO, Jay Bregman, “or any recreational operator.”

Depending upon your business application and how many times a year you fly, on-demand insurance may be just what you’re looking for – but it may not always be the best, or even the most inexpensive, option.

Cost counts

“Verifly wasn’t designed to cover everyone,” says UAV insurance specialist Evan Garmon of Harpenau Insurance in Indiana. “It really works best for the hobby or small commercial operator who is flying a few times a year – like a real estate agent going up only for a few choice properties.” Garmon says the math is clear. Verifly currently prices a basic, low-risk application – that’s flying in an open area not around any restricted airspace – at $10/hour; that provides a drone with $1 million in liability coverage. An annual policy offering coverage for a single drone runs pretty consistently between $800 – $875 per year; so a business flying more than 80 hours a year with one drone- that’s less than a couple of hours a week – might save money on an annual policy. Professional operators with 200-1000 hours of expert flying experience may qualify for discounts.

If you aren’t flying in low-risk areas, the cost benefit of on-demand insurance goes down further; the price per hour rises depending upon your location.

Bregman says this dollar-to-dollar comparison may not tell the whole story, however. Operators with more than one drone who want to choose the best drone for their current application will need a policy for each, which could double their cost; the Verifly cost is the same regardless of which drone you use. And an annual policy requires an annual investment, which can be difficult for new businesses unsure of their cash flow: with an annual policy “that drone is costing you money whether it’s on the ground or in the air,” says Bregman. “For a lot of people, that doesn’t make sense.” Finally, there is the issue of applying for annual policies, which may not be an easy process for a small operator to navigate. “When you compare the costs of an annual policy you really have to take the friction of the application process into account,” Bregman comments. Verifly doesn’t have an application process, providing insurance for each job immediately.

Who Pays?

Many drone businesses using on-demand insurance add the insurance as a line item to their bill. Customers are generally happy to pay for insurance that they requested; and it’s clear that on-demand insurance is an expense incurred specifically for the customer’s job, rather than a general overhead expense. The ability to pass on the cost is a benefit to many small drone businesses, who otherwise would have to shoulder the costs of insurance themselves.

What’s Covered?

On-demand insurance “puts a lot more control in the hands of the operator,” says Garmon. “That can be both good and bad.” While on-demand insurance offers operators fast proof of coverage for an occasional need, coverage is limited – and new commercial drone operators may not realize that they need a bigger policy. Verifly only covers liability on your drone if you hit someone or damage their property; it doesn’t cover personal liability if someone should accuse the operator of illegal behavior, or physical damage to the drone itself. For small operators using an inexpensive drone, that may not be a concern: but for a commercial operation using industrial aircraft it’s significant. “When a drone costs over $3,000, it starts to make a difference,” says Garmon, who estimates that coverage on a $3,000 drone would generally run about $450 annually. Unfortunately, you can’t generally get one type of insurance without the other – using an on-demand insurance for liability and getting a smaller policy just for physical damage to the drone -insurance companies will require that you carry both.

Additionally, on-demand insurance may not cover the other business requirements in your state. Some states require that businesses carry worker’s comp insurance, for example, or insurance on a business vehicle. If you aren’t sure, it may be time to get an agent: “I don’t mean to be prejudiced,” laughs Garmon. “But the benefit of having an agent is the expertise – they can customize for your business. If you’re growing a business, you might have other needs.”

How Much Do You Need?

Verifly’s current standard liability coverage is $1 million – but you can’t double up to up the total. The company has a strict “no stacking” policy, which means that you can’t use their policy on top of another to increase your coverage, or try to use two of their policies to double your coverage. If you need more than the currently offered amount, you’ll have to go to another broker.

That being said, Verifly’s coverage options are about to change. Prior to the end of the year, the company plans to release new features including coverage of up to $2.5 million, and 4 -8 hour packages.

Location, location, location.

Verifly works by providing coverage within a restricted area and a restricted timeframe – “precision insurance.” The coverage area is currently a .25 mile radius from the location that you specify; future updates – planned for release before year end – may increase the zone to .5 miles. But if you’re flying outside of the pre-defined area, you aren’t covered. And while a new update will also allow users with a waiver or permissions to fly in restricted airspace, currently that’s not an option. Correction: An earlier version of this article incorrectly stated that Verifly does not cover fly-aways – but the good news for drone operators is that unintentional flyways do not invalidate your Verifly insurance. Finally, Verifly is currently offered in 45 states – if you’re considering using it for an upcoming job, be sure to check availability first.

For new commercial drone businesses, getting a Part 107 license is just the first step – building a new business involves many more. Businesses should research insurance options and requirements in their state: “Licensed and insured” is a tagline all operators should offer.